New

Announcing our $7.5m funding round

Keep your insurance. Ditch the surprise rate hikes.

Keep your insurance. Ditch the surprise rate hikes.

Keep your insurance. Ditch the surprise rate hikes.

Starting at $7/mo, Premium Lock guarantees your current home insurance policy won’t exceed a specific price over the next 3 years.

Starting at $7/mo, Premium Lock guarantees your current home insurance policy won’t exceed a specific price over the next 3 years.

Starting at $7/mo, Premium Lock guarantees your current home insurance policy won’t exceed a specific price over the next 3 years.

Get my price

No personal info required.

How Premium Lock works

Step 1

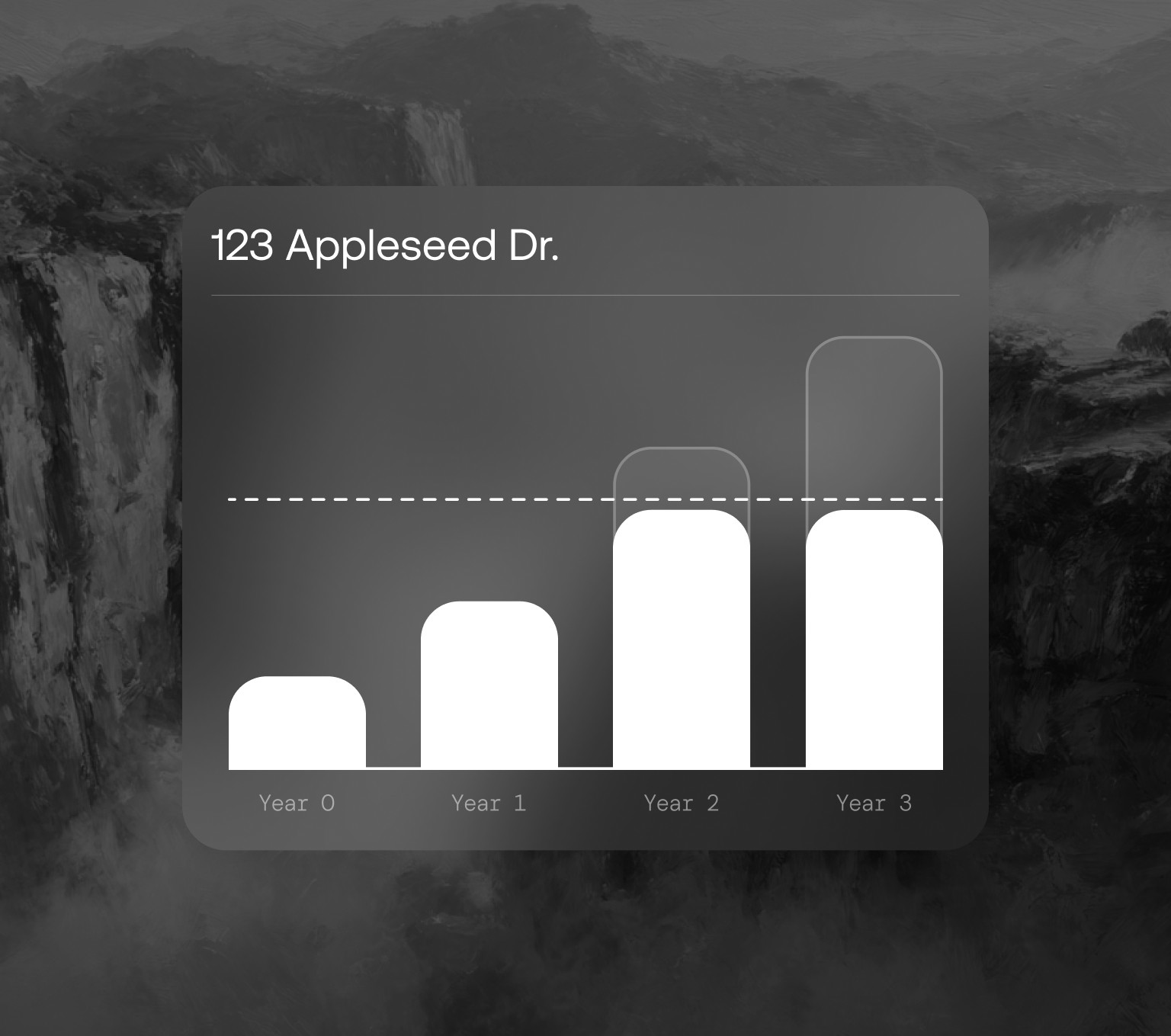

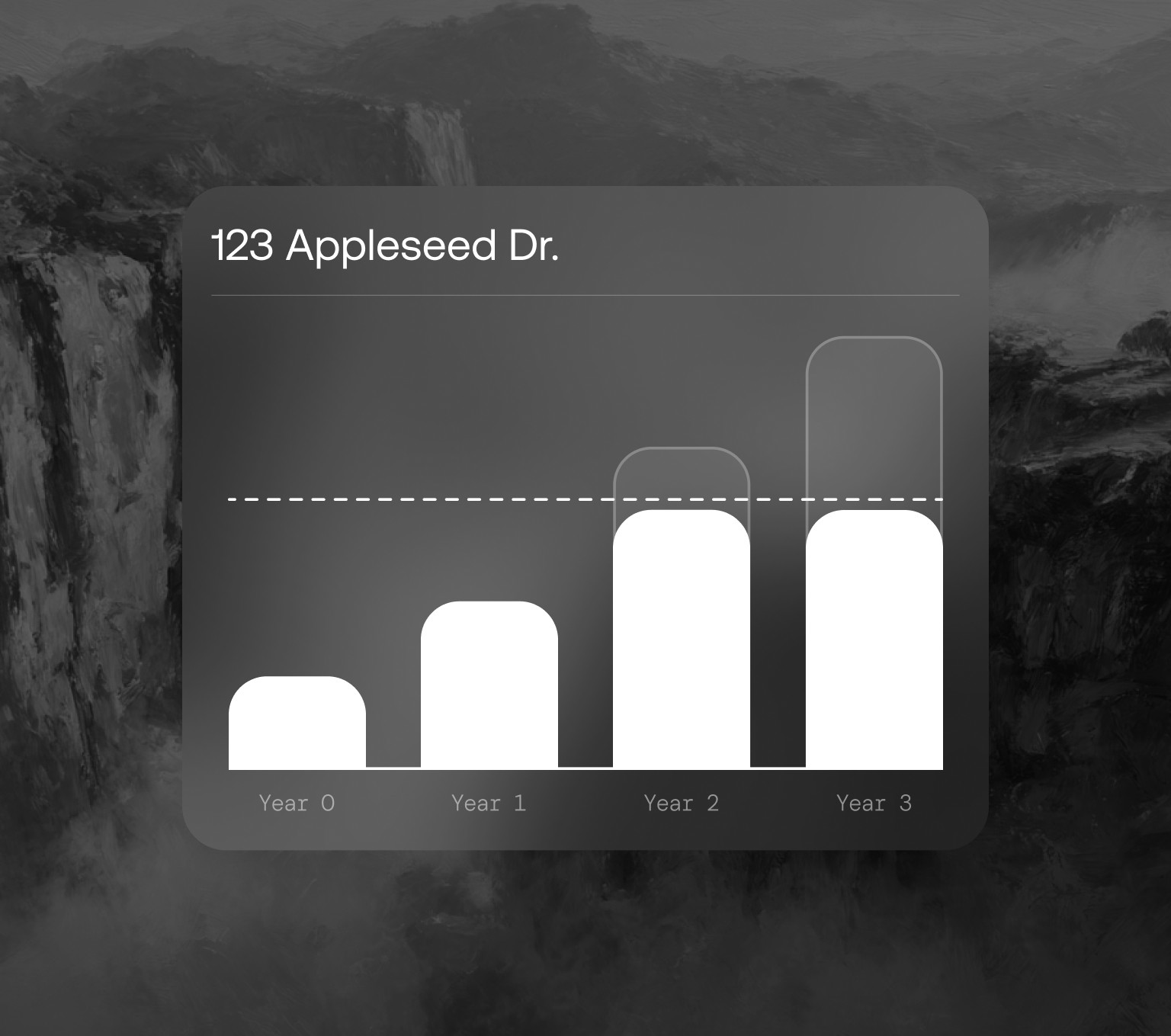

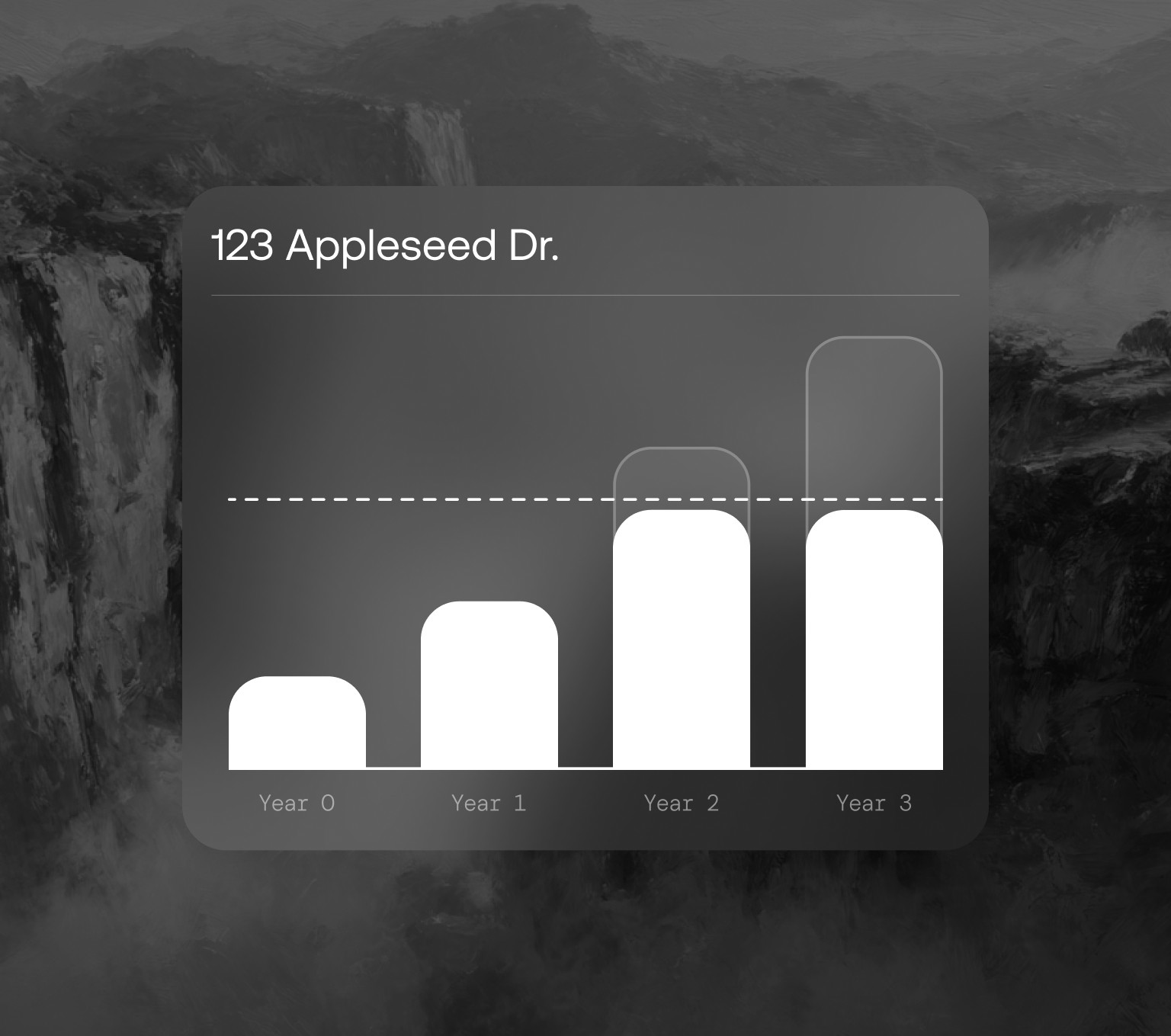

Get Prediction

Starting at $7/mo, we predict your home insurance premiums for 3 years, accuracy guaranteed.

Step 2

Carrier Raises Premiums

At renewal of your home insurance policy, your carrier decides to increase premiums.

Step 3

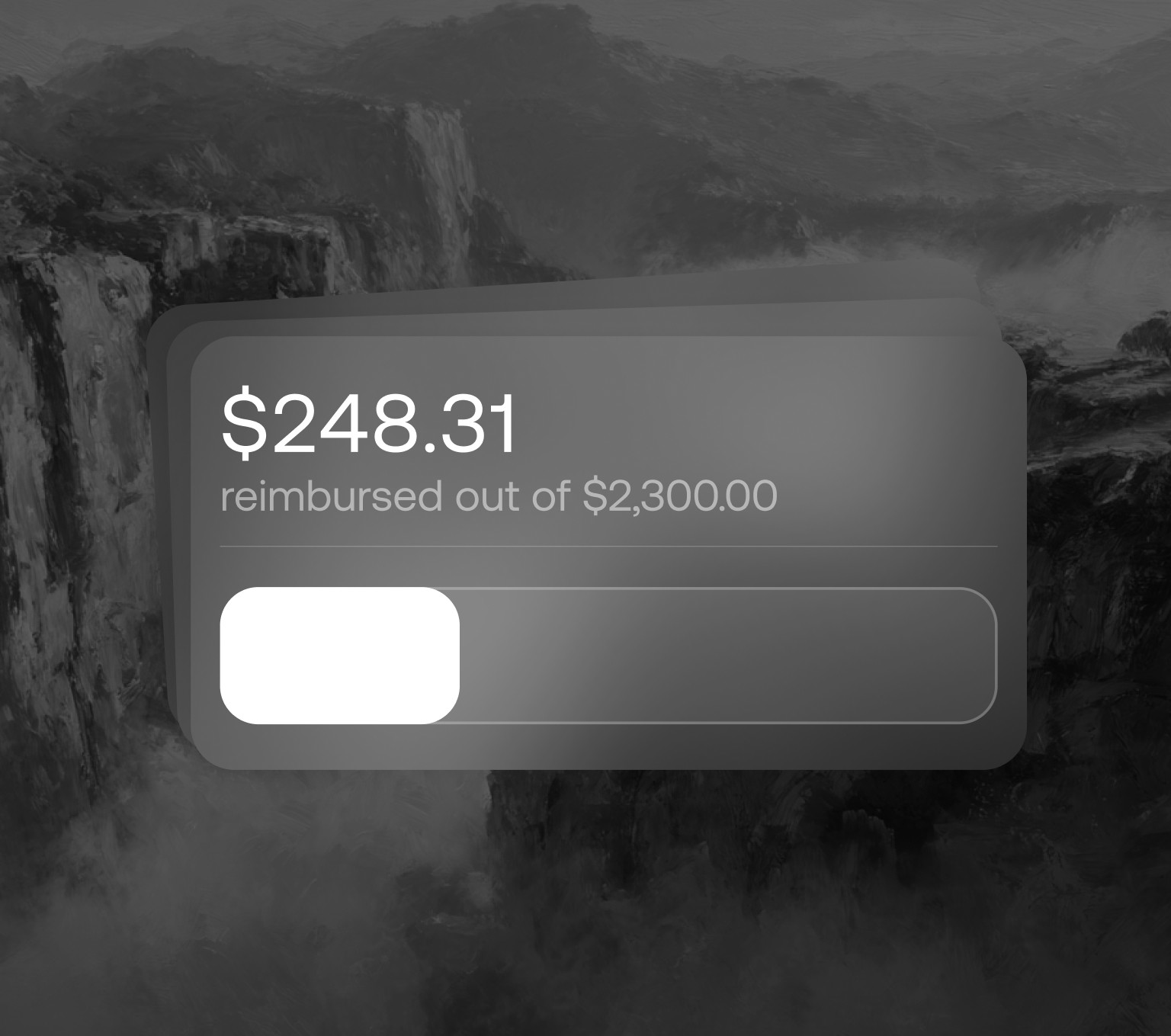

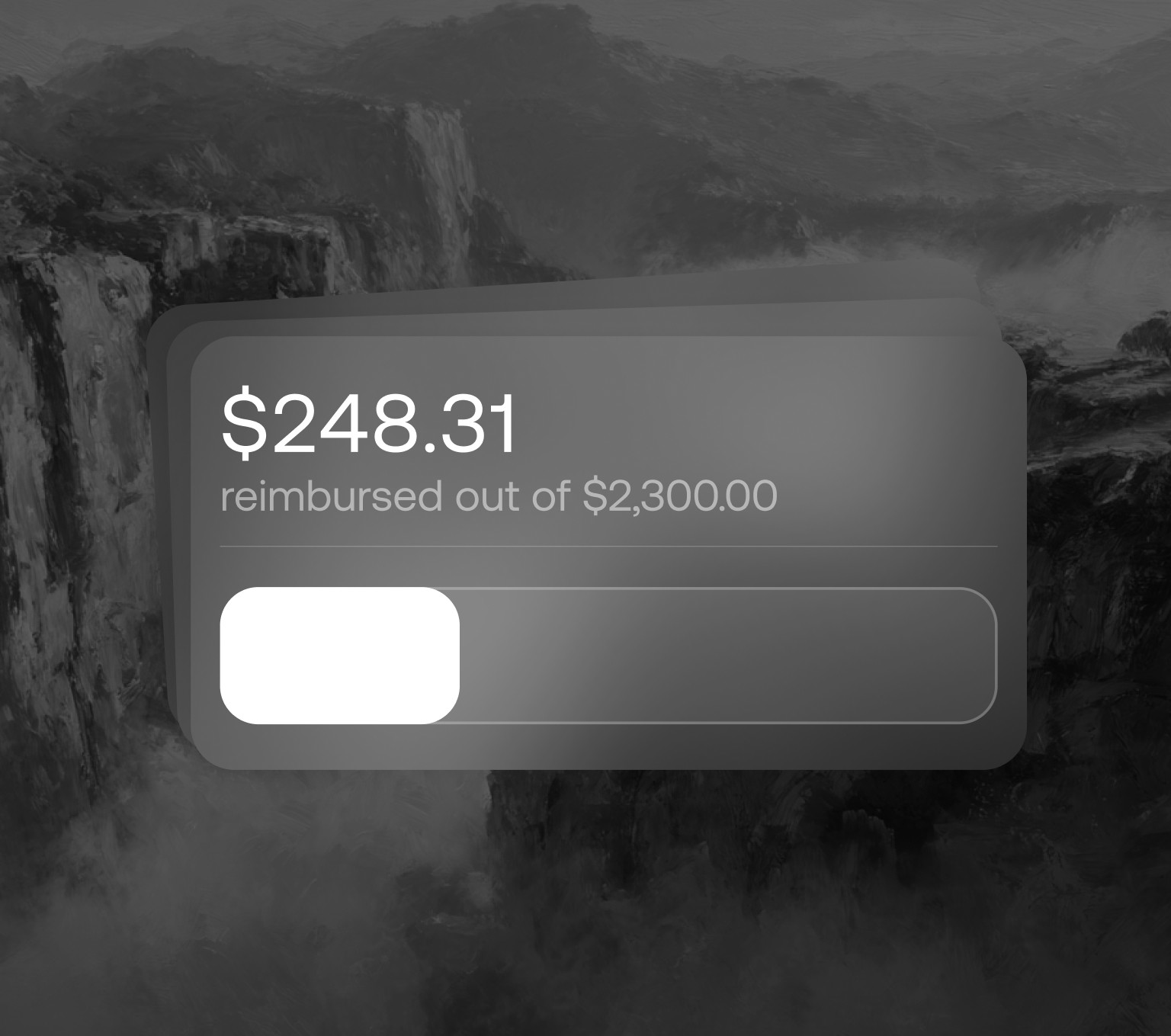

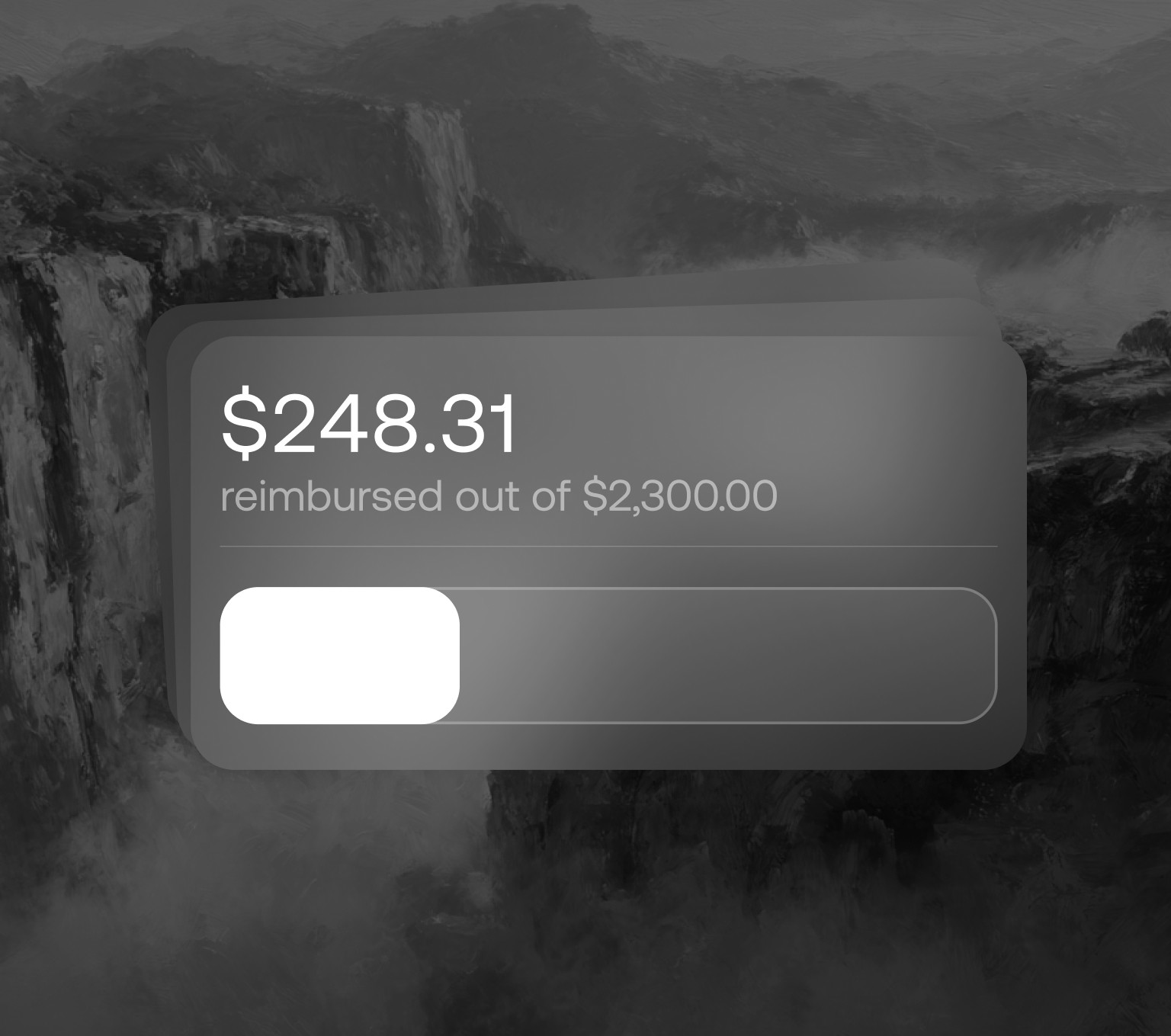

Get Reimbursed

Once verified, we cover the increased premiums by reimbursing you directly.

How Premium Lock works

Step 1

Get Prediction

Starting at $7/mo, we predict your home insurance premiums for 3 years, accuracy guaranteed.

Step 2

Carrier Raises Premiums

At renewal of your home insurance policy, your carrier decides to increase premiums.

Step 3

Get Reimbursed

Once verified, we cover the increased premiums by reimbursing you directly.

How Premium Lock works

Step 1

Get Prediction

Starting at $7/mo, we predict your home insurance premiums for 3 years, accuracy guaranteed.

Step 2

Carrier Raises Premiums

At renewal of your home insurance policy, your carrier decides to increase premiums.

Step 3

Get Reimbursed

Once verified, we cover the increased premiums by reimbursing you directly.

You can count on us.

Behind Premium Lock is a team of insurance experts from top institutions you can trust.

Join homeowners in 20+ states already using Premium Lock

You can count on us.

Behind Premium Lock is a team of insurance experts from top institutions you can trust.

Join homeowners in 20+ states already using Premium Lock

You can count on us.

Behind Premium Lock is a team of insurance experts from top institutions you can trust.

Join homeowners in 20+ states already using Premium Lock

Still have questions?

Read our FAQ

How does Premium Lock work?

Premium Lock is the best way to get your existing home insurance premiums to behave for the long term. You can buy Premium Lock directly on our website (click 'Get a Quote') or from your independent insurance agent. To get a quote, enter your address and answer a few questions about your current insurance policy. Based on this information, we use our predictive model to forecast how much your home insurance premiums are likely to grow over the next 3 years. We guarantee the accuracy of this prediction. If your carrier ends up raising your rates beyond our prediction, we'll pay you back for the difference. By guaranteeing our predictions, your existing one-year insurance policy starts to act more like a 3-year policy. You continue to pay your carrier as usual—Premium Lock reimbursements are paid directly to your personal bank account when triggered.

Why do I need this?

American real estate owners have seen property insurance premiums grow dramatically over the last few years. Some have seen premiums double or triple since 2020. This is an affordability headwind for homeowners, and a predictability issue for commercial real estate. We see multi-year insurance as the solution, allowing real estate owners to understand exactly what their insurance premiums will be for years into the future. But rather than replacing your insurance company entirely, Eventual's Premium Lock simply bolts onto your existing policy—no need to swap carriers, agents or brokers. Predictability and affordability is the answer, and Premium Lock offers exactly that.

Who is this for?

Premium Lock is currently available to US homeowners insured with standard, admitted-lines homeowners insurance. Excess and surplus lines are currently not eligible for homeowners, but may be acceptable for certain landlord policies. Premium Lock is also available for US commercial property insurance policies and master programs. Given the complexity of these policies, please email us or book a demo at the links on this page to go through your exposure in more detail. We can assemble a quote quickly using your (i) declarations pages, (ii) statements of values and (iii) any other relevant docs, including your broker's latest insurance proposal.

Can I change my policy terms?

Certain terms of your existing insurance policy directly impact the price of that policy. For this reason Eventual sets guidelines for eligible changes to a customer's underlying insurance policy. For example, you can change carriers, but cannot manually increase the property insurance limit or decrease the deductible. Fortunately, most homeowners set the terms of their insurance policies and leave them unchanged for years.

How is my payout recieved?

You are eligible for a payout if your renewal premiums exceed our prediction. If you are eligible, we'll email you directly to confirm your preferred reimbursement method. Funds are transferred via ACH directly to your bank account.

Still have questions?

Read our FAQ

How does Premium Lock work?

Premium Lock is the best way to get your existing home insurance premiums to behave for the long term. You can buy Premium Lock directly on our website (click 'Get a Quote') or from your independent insurance agent. To get a quote, enter your address and answer a few questions about your current insurance policy. Based on this information, we use our predictive model to forecast how much your home insurance premiums are likely to grow over the next 3 years. We guarantee the accuracy of this prediction. If your carrier ends up raising your rates beyond our prediction, we'll pay you back for the difference. By guaranteeing our predictions, your existing one-year insurance policy starts to act more like a 3-year policy. You continue to pay your carrier as usual—Premium Lock reimbursements are paid directly to your personal bank account when triggered.

Why do I need this?

American real estate owners have seen property insurance premiums grow dramatically over the last few years. Some have seen premiums double or triple since 2020. This is an affordability headwind for homeowners, and a predictability issue for commercial real estate. We see multi-year insurance as the solution, allowing real estate owners to understand exactly what their insurance premiums will be for years into the future. But rather than replacing your insurance company entirely, Eventual's Premium Lock simply bolts onto your existing policy—no need to swap carriers, agents or brokers. Predictability and affordability is the answer, and Premium Lock offers exactly that.

Who is this for?

Premium Lock is currently available to US homeowners insured with standard, admitted-lines homeowners insurance. Excess and surplus lines are currently not eligible for homeowners, but may be acceptable for certain landlord policies. Premium Lock is also available for US commercial property insurance policies and master programs. Given the complexity of these policies, please email us or book a demo at the links on this page to go through your exposure in more detail. We can assemble a quote quickly using your (i) declarations pages, (ii) statements of values and (iii) any other relevant docs, including your broker's latest insurance proposal.

Can I change my policy terms?

Certain terms of your existing insurance policy directly impact the price of that policy. For this reason Eventual sets guidelines for eligible changes to a customer's underlying insurance policy. For example, you can change carriers, but cannot manually increase the property insurance limit or decrease the deductible. Fortunately, most homeowners set the terms of their insurance policies and leave them unchanged for years.

How is my payout recieved?

You are eligible for a payout if your renewal premiums exceed our prediction. If you are eligible, we'll email you directly to confirm your preferred reimbursement method. Funds are transferred via ACH directly to your bank account.

Still have questions?

Read our FAQ

How does Premium Lock work?

Premium Lock is the best way to get your existing home insurance premiums to behave for the long term. You can buy Premium Lock directly on our website (click 'Get a Quote') or from your independent insurance agent. To get a quote, enter your address and answer a few questions about your current insurance policy. Based on this information, we use our predictive model to forecast how much your home insurance premiums are likely to grow over the next 3 years. We guarantee the accuracy of this prediction. If your carrier ends up raising your rates beyond our prediction, we'll pay you back for the difference. By guaranteeing our predictions, your existing one-year insurance policy starts to act more like a 3-year policy. You continue to pay your carrier as usual—Premium Lock reimbursements are paid directly to your personal bank account when triggered.

Why do I need this?

American real estate owners have seen property insurance premiums grow dramatically over the last few years. Some have seen premiums double or triple since 2020. This is an affordability headwind for homeowners, and a predictability issue for commercial real estate. We see multi-year insurance as the solution, allowing real estate owners to understand exactly what their insurance premiums will be for years into the future. But rather than replacing your insurance company entirely, Eventual's Premium Lock simply bolts onto your existing policy—no need to swap carriers, agents or brokers. Predictability and affordability is the answer, and Premium Lock offers exactly that.

Who is this for?

Premium Lock is currently available to US homeowners insured with standard, admitted-lines homeowners insurance. Excess and surplus lines are currently not eligible for homeowners, but may be acceptable for certain landlord policies. Premium Lock is also available for US commercial property insurance policies and master programs. Given the complexity of these policies, please email us or book a demo at the links on this page to go through your exposure in more detail. We can assemble a quote quickly using your (i) declarations pages, (ii) statements of values and (iii) any other relevant docs, including your broker's latest insurance proposal.

Can I change my policy terms?

Certain terms of your existing insurance policy directly impact the price of that policy. For this reason Eventual sets guidelines for eligible changes to a customer's underlying insurance policy. For example, you can change carriers, but cannot manually increase the property insurance limit or decrease the deductible. Fortunately, most homeowners set the terms of their insurance policies and leave them unchanged for years.

How is my payout recieved?

You are eligible for a payout if your renewal premiums exceed our prediction. If you are eligible, we'll email you directly to confirm your preferred reimbursement method. Funds are transferred via ACH directly to your bank account.

EVENTUAL SERVICES LLC (C) 2025, ALL RIGHTS RESERVED

Please read our Terms of Service and our Privacy Notice carefully because they govern your use of our site and services accessible via the Site offered by Eventual Services LLC. The services are not an insurance policy or a financial derivative product. The terms are not intended to constitute an offer to insure, do not constitute insurance or an insurance contract, and do not take the place of insurance obtained or obtainable by you. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice. All rights to the trademarks and/or logos presented herein belong to their respective owners and Eventual’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos. Clarity of text may be affected by the size of the screen on which it is displayed. Certain information contained in this material has been obtained from sources outside Eventual, which in certain cases has not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Eventual, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates.